Buy Sell Silver: A Comprehensive Guide to Investing in Precious Metals

Investing in silver, along with other precious metals such as gold, platinum, and palladium, has emerged as a prominent trend among both seasoned and new investors alike. The stability and value that silver offers can serve as a great hedge against inflation and economic downturns. This article will explore in detail how to buy sell silver, insightful tips for beginners, and the key considerations when entering the precious metals market.

Understanding Silver as an Investment

Before diving into the specifics of buying and selling silver, it is essential to understand why silver is considered a valuable investment. Silver has been used as a form of currency and a store of value for centuries. Here are some reasons why investing in silver is advantageous:

- Inflation Hedge: Silver often maintains its value during periods of inflation, making it a reliable asset to hold.

- Diverse Uses: Beyond investment, silver has industrial applications, including electronics, solar panels, and medical devices.

- Affordability: Compared to gold, silver is a more accessible investment option for the average investor.

- Market Demand: The demand for silver in various industries drives its price and potential for appreciation.

Types of Silver Investments

When considering how to buy sell silver, it's important to recognize the different forms that silver investments can take:

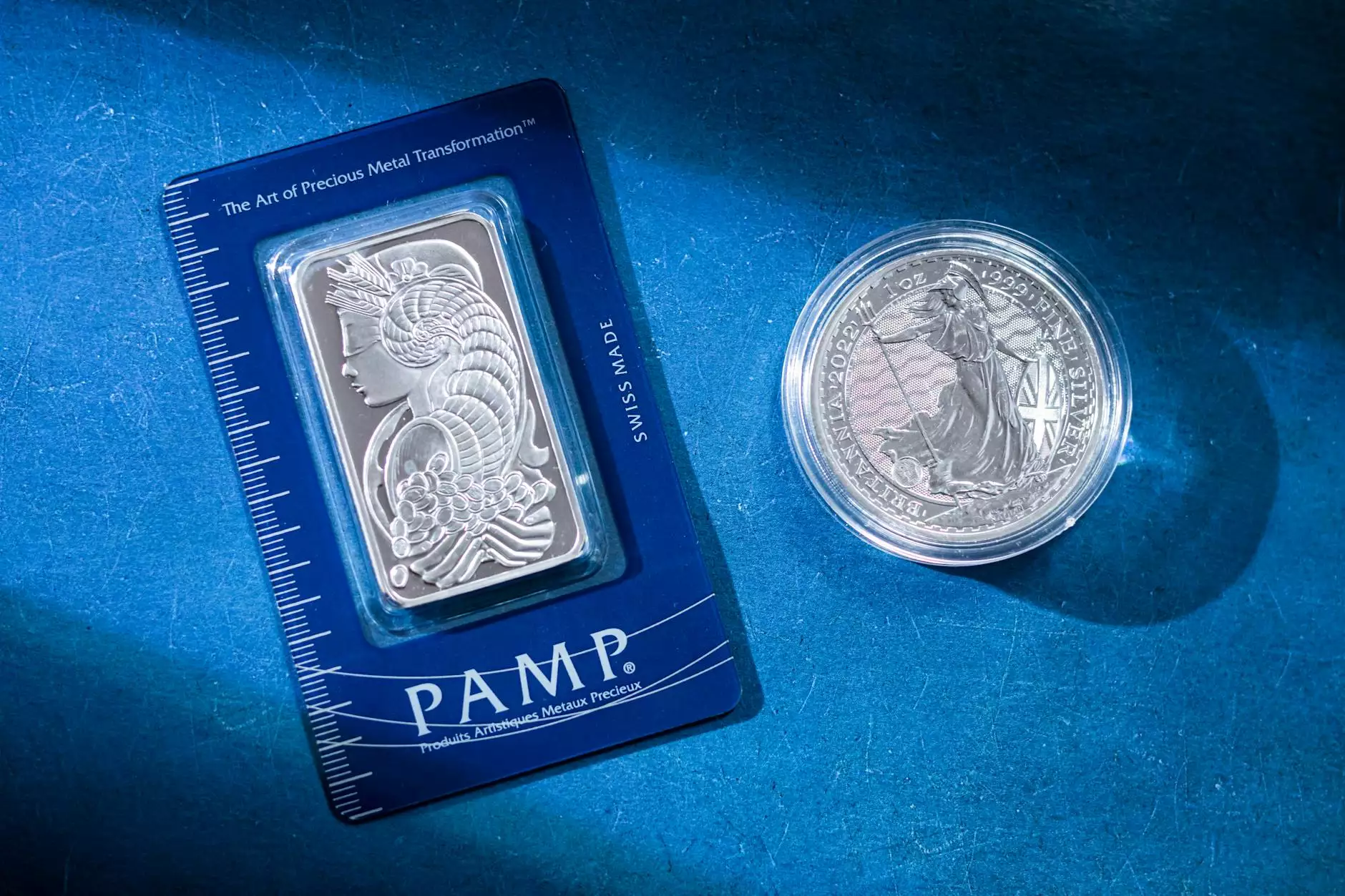

1. Silver Bullion

Silver bullion typically refers to physical silver in the form of coins or bars. These are usually purchased for their intrinsic value based on their weight and purity. Popular options include:

- American Silver Eagles

- Canadian Silver Maple Leafs

- Silver Bars

2. Silver ETFs (Exchange-Traded Funds)

Investors can also gain exposure to silver through ETFs. These funds track the price of silver and provide an easy way to invest without the need for physical storage.

3. Silver Stocks

Another option is to invest in companies that mine silver. These stocks can offer leverage to the price of silver, although they also carry operational risks.

How to Buy Silver: A Step-by-Step Guide

If you're ready to buy sell silver, here is a comprehensive step-by-step guide to help you through the process:

Step 1: Research and Choose Your Silver Type

Identify the type of silver investment that best suits your financial goals. Here are a few questions to consider:

- Do you want physical silver or are you interested in paper assets?

- Are you looking for long-term storage or quick liquidity?

Step 2: Find a Reputable Dealer

Once you've decided on the type of silver to purchase, find a reputable dealer. Look for dealers with:

- Positive reviews: Read customer experiences.

- Memberships: Join organizations like the Professional Numismatists Guild (PNG).

- Transparency: A trustworthy dealer should provide pricing and fees upfront.

Step 3: Make Your Purchase

When you're ready to buy, you will typically follow these steps:

- Select the volume and type of silver you wish to purchase.

- Review the total cost, including applicable shipping and handling fees.

- Choose your payment method, which may include credit cards, bank transfers, or in some cases, cash.

Step 4: Secure Storage

Physical silver needs to be stored securely to protect your investment. Consider options such as:

- Safe deposit boxes in banks.

- Home safes specifically designed for storing valuables.

- Professional storage solutions offered by investment firms.

How to Sell Silver

Knowing when and how to sell your silver can be just as important as knowing how to buy it:

1. Monitoring the Market

Keep an eye on silver prices and market trends. Use websites and tools dedicated to tracking precious metals.

2. Choose the Right Time

Timing your sale can potentially maximize your profits. Consider selling when prices are higher than your purchase price to realize gains.

3. Find a Buyer

When you decide to sell, you have several options:

- Return to the dealer you bought from.

- List your items on an online marketplace.

- Attend a local coin show or trade event.

4. Setting the Price

To set a fair price, consider factors such as:

- The current market price of silver.

- The condition and rarity of your silver items.

- Any premiums that were originally paid.

Long-Term Considerations for Silver Investments

While investing in silver can provide short to medium-term gains, it's crucial to look at the long-term picture:

Diversification

Diversifying your investment portfolio can help mitigate risks. Combine silver with other asset classes such as stocks, bonds, and real estate to create a balanced portfolio.

Stay Informed

The precious metals market can be influenced by numerous factors, including geopolitical events, market trends, and investor sentiment. Stay informed through:

- Financial news outlets.

- Market analysis reports.

- Investment blogs and forums.

Conclusion

In summary, investing in silver is a rewarding venture for those who do their due diligence. Whether you are looking to buy sell silver for the first time or you are a seasoned investor, understanding the market dynamics and the available options is key to your success. By following the steps outlined in this guide and keeping abreast of market trends, you can make informed decisions that align with your financial goals.

For the best in silver bullion purchases and expert advice, visit us at DonsBullion.com. Join us on the journey of investing in precious metals and secure your financial future today!